What Are Next of Kin Laws?

It’s All in the Name

To put it simply, when a will does not exist, it can be a nightmare figuring out what to do. This is where next of kin laws come into play. In short – next of kin laws explain who gets what when you die without a last will and testament. By far, the most commonly found next of kin laws are found in the state intestacy laws. Intestate succession laws determine who will take title to a deceased person’s property when that person dies without a will. In California, distribution of a decedent’s estate follows a defined set of rules which are straightforward and provide a clear-cut plan for transferring ownership of a decedent’s property.

The Official Definition The Colorado Probate Code defines the term "next of kin" as "all of the living blood relatives of an intestate, including any living blood relatives of a higher degree than the intestate."

Example: If you possess no spouse, are not a recognized civil union registrant, are not a surviving partner of a registered household, are not a child of a parent that has been declared incompetent, and have no domestic partner, you are next of kin . This means that titles that would otherwise go to your parents, children, siblings, grandchildren and so on will belong to your next of kin. It should be noted that if you die leaving behind a husband/daughter/son/father/mother type of relation, that person is your next of kin, regardless of how the laws define next of kin. Your next of kin will benefit from your estate proportionately to the next of kin laws laid out below.

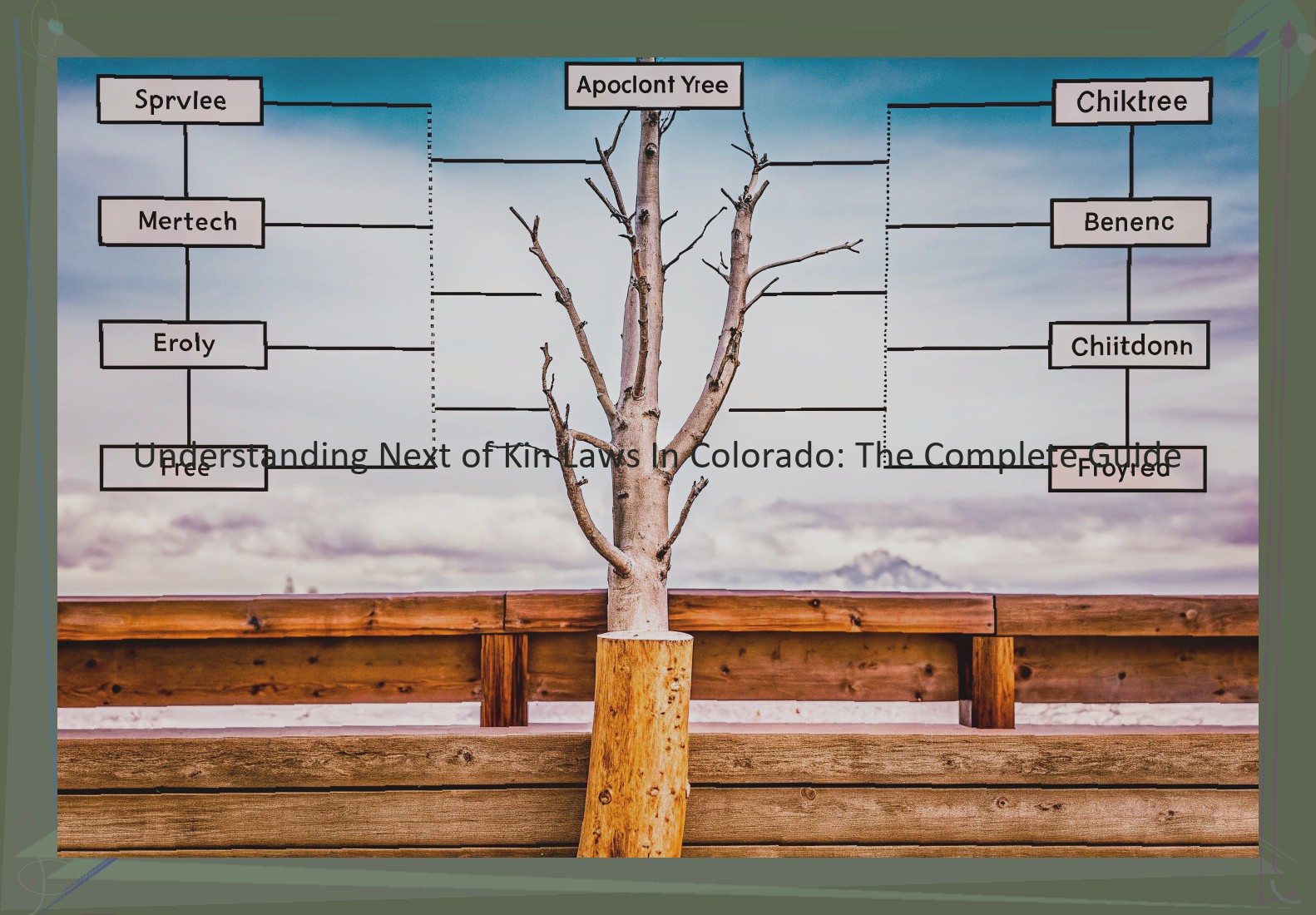

Who Is Your Next of Kin? These are the people and how they are lined up, first to last, as Colorado next of kin laws view them: When determining rights under Colorado law, it’s important to understand the order of priority of relatives. In addition to order of priority, there are other determining characteristics as well. For example, cousins are not usually members of the immediate family and are thus last in line for property in Colorado. Once the immediate family line has been exhausted, distant relatives may be included, but not usually cousins. Aunts, uncles, nieces, nephews, and far removed relatives, such as second or even third cousins may be awarded a share of the estate.

The Next of Kin Hierarchy In Colorado

The hierarchy of the next of kin generally follows the order of a decedent’s family tree, extending from the most immediate family to more distant relatives. Under Colorado law, a surviving spouse or members of the first degree of kinship has priority over all other persons and the following describe both the degree of kinship and its order:

- The spouse of the decedent;

- Children of the decedent, including children adopted by the decedent;

- Parents of the decedent; or

- Brothers and sisters of the decedent;

Once it is established that there is no spouse surviving, a child of decedent is the next in line.

"Children," in the hierarchy of the next of kin, refers to not only biological children but also those who are adopted by the decedent. As an example, if the decedent adopted a child this child would clearly be in line for a decision making authority just as the natural children of the decedent. Adopting a child effectively severs the adopted child from the birth parents’ blood or kinship relationship, but not from the adoptive parents’ own family.

In addition to natural and adopted children, under Colorado law, children conceived but not yet born also stand as next of kin of the decedent. Under C.R.S. § 15-11-103(13) a person who is in gestation at a particular time is treated as living at the time of such a time. The unborn child can be treated as the child or heir of a deceased parent for the purpose of intestate succession; therefore, an unborn child is included in the hierarchy of next of kin.

As a general rule, a surviving father of a illegitimate child will not be included in the hierarchy of the next of kin. However, this rule does not apply if the father has legally adopted the child or has been declared by a court to be the father of the child.

While grandparents of a decedent do not have priority over parents in intestacy proceeding, if the biological mother passes away while giving childbirth, the decedent’s maternal grandparents would assume the role as the legal guardians of the decedent’s child. In a case where there was a dispute between the father of the child and the decedent’s maternal grandparents, the court ruled that the maternal grandparents had priority of the decedent’s child and the child’s interest in her parents’ estate.

The hierarchy of next of kin is not limited to a descendant’s parents, grandparents, siblings or children, but also includes the decedent’s grandchildren, if the grandchildren are financially dependent on their grandparents at the decedent’s death.

Under C.R.S. § 15-11-201, a grandchild stands in the place of his or her deceased parent. Therefore, if one of the decedent’s children die before him, a grandchild would inherit his share of the lineal descent or inheritance. The above mentioned hierarchy of the next of kin is outlined in C.R.S. § 15-11-201 (1). It is important to note that priority for granting authority is given to the more closely related kin of the decedent.

Legal Rights Afforded To Next of Kin

The term "next of kin" refers to a person’s closest living blood relatives. Colorado law gives next of kin a number of legal rights with respect to those who they are the "next of kin" for. Those rights are primarily governed by two sets of statutes: the Probate Code and the Medical Decision-Making Act. However, certain issues such as Durable Powers of Attorney and issues with insurance companies are governed by other sets of laws.

Generally speaking, the "next of kin" for an adult who dies without a will is his or her children. If there are no children, then the next of kin is his or her parents. Then the next of kin would be a sibling, and if there are no siblings of a parent, then the next of kin would be either a grandparent or a grandchild. The concept of "next of kin" can be a very complicated legal issue.

Many issues that arise with respect to next of kin are the result of a tragic accident or a catastrophic set of medical events resulting in someone falling into a coma. In those situations, the legal considerations are whether the next of kin can make medical decisions on behalf of the incapacitated person. In cases where no Durable Power of Attorney has been executed, the Medical Decision-Making Act governs the order in which people may make medical decisions. The hierarchy is as follows for an adult (not under age 18): 1) a parent with priority over another parent; 2) the adult child of the patient having priority over the other adult children; 3) the surviving spouse having priority over the surviving domestic partner or survivors of the surviving domestic partner; 4) an adult sibling having priority over an adult niece, nephew, aunt, uncle, cousin, or grandparents of the patient; 5) an adult grandchild of the patient.

If there is no spouse, child, sibling, parent, other relative, or other adult responsible for the care of the patient, the court in appropriate proceedings may appoint an authorized fiduciary – which could be a hospital or any other entity – as the representative of the patient. However, the hospital is not entitled to prioritize treatment over next of kin. Every effort must be made to involve the next of kin or other surrogate adult in each decision to withhold, withdraw, deny, or withdraw treatment or operation from the patient suffering from a terminal condition, an irreversible condition, or a condition requiring substantial assistance. In the absence of treating physicians stating otherwise in writing, withholding treatment is not appropriate.

Next of kin has legal rights in the administrative procedures for estates of decedents. The Personal Representative is responsible for the overall administration of the Estate. There is no requirement that the Personal Representative be a next of kin. However, an heir has the right to have the Personal Representative removed if the PR is not fulfilling his or her legal duties to the estate.

If there is a Durable Power of Attorney in place, the agent named in the DPA has most or all rights and responsibilities with respect to the health care and financial affairs of that person while the person is alive. The use of a DPA is important for many reasons. A DPA can help to lessen or even remove a person’s decision-making responsibilities when they have reached a certain age. For example, a person named to manage money in a DPA may be able to use it to pay bills for a parent who suffers from dementia or another similar type of inability to manage his or her own affairs.

Disputes And Challenges

While the NEXT OF KIN rules were provided to ensure an orderly means of ensuring the transfer of property and providing for the final affairs of a decedent, disputes, misunderstandings, and other challenges have arisen. The most common dispute is that by a surviving spouse of the deceased who believes that they are entitled to a greater share of the estate than provided for by the laws of intestacy in Colorado. When a spouse enters into a marriage, there typically is a property settlement agreement setting out the property to which each spouse is entitled as part of the marital estate. In the event there is no agreement, or the agreement is not properly drafted and recorded, the surviving spouse of the decedent can be placed in the position of being last in line when it comes time to inherit their spouse. In certain circumstances, a surviving spouse may be entitled to a personal property allowance. A personal property allowance can reduce the amount of money that a spouse would otherwise be entitled to under Colorado law. However, the Personal Property Allowance is not automatic; the surviving spouse must file a petition with the Court and provide notice to various family members of the decedent and any other persons who may have an interest in the decedent’s estate.

In the event that there is a dispute between a surviving spouse and other family members, a probate proceeding under Colorado’s intestacy laws will generally help to bring an orderly resolution to the dispute. An attorney experienced in the handling of Colorado estate proceedings will frequently meet with the surviving spouse and their attorney and attempt to obtain and file an affidavit with the court that sets forth an agreed upon distribution of the last will and testament of the decedent. In the event that there is no agreement by the family member, the Court can preside over the estate and resolve any disputes between the family automatically.

Updating Next of Kin Information

It is important to maintain accurate and timely information regarding your "next of kin" at all times. Lapses in having up-to-date information could delay or deny important benefits. You should consider the following to keep your next of kin information up to date.

Ensuring your information is up to date for pending or future probate matters. To ensure you have the proper individuals listed under Colorado law, it is always advisable to review and update your next of kin information whenever you find changes in material information. This could be through marriage, divorce, separation, death , or some other form that personal or financial matters require. It is always better to have this done long before such information is required to use.

Choosing the Correct Next of Kin. The law sets forth an order of preference in individuals who would be used as your next of kin in Colorado. In many cases, it is your spouse, except if they are incompetent due to a decision made by a physician. If you do not have a spouse, living parents, or children, any surviving siblings can be used as your next of kin. If none of the above apply, any living relatives can be used as a next of kin.

Other Issues. If there are other family members, having your wishes clearly stated and understood by others could save time and energy.

How Next Of Kin Laws Apply To Wills And Estates

In the context of Colorado Next of Kin laws, the term "next of kin" refers to a deceased individual’s blood relatives. As specified in the Colorado Probate Code, next of kin inherit property automatically if there is no will present or a will is deemed invalid. The ensuing sections highlight ways next of kin laws interact with wills and estates.

It’s important to note not all next of kin are equally eligible to receive assets in the absence of a will. To illustrate, if a surviving spouse, domestic partner or civil union partner (if legally married) exists, that person has priority over the deceased individual’s parents and siblings. If there are no surviving family members (i.e. parents, siblings, offspring, etc.), the court goes outside the family unit.

Specific next of kin laws dictate how estate property can be passed on to another human being. Referred to as intestacy laws, these regulations are usually based on which relative was closest to the deceased. For example, offspring of the decedent usually claim full stake to the estate if the decedent has no surviving relatives such as parents or siblings. If the decedent does have living siblings and/or parents, then the next of kin laws states assets must be divided among them. In other words, if the decedent had two siblings who are both alive, each sibling would get 50 percent of the estate value. If all three siblings were still alive, then each sibling would walk away with 33.33 percent of the estate….and so on.

Despite the common belief that a regular last will and testament is the only legal means of distributing wealth between family and friends after death, it’s important to understand that a will has no legal power until after a human dies. Without a valid will, next of kin laws determine estate distribution. As long as all beneficiaries named in a will are alive before death, they must respect the final wishes of the deceased. In some instances, close family members may contest the terms of the will if substantial grounds for doing so exist. There are two typical grounds for will contestation, including undue influence and a lack of testamentary capacity.

A lack of testamentary capacity occurs when a deceased person had insufficient mental ability or was sufficiently impaired by drugs or alcohol at the time of signing the will. Undue influence sees a person close to the deceased person use coercive means to gain something of value prior to the decedent’s death. If a will is successfully contested, it is invalid and therefore not probated or executed. As a result, existing next of kin laws apply….and the decedent’s estate is equally divided between the survivors.

Resources & Legal Help

For those seeking to further understand their rights and responsibilities with regard to next of kin matters in Colorado, resources are available through a variety of legal and community organizations. Legal aid societies such as the Colorado Legal Services provide free or low-cost legal assistance in a wide array of civil matters, including estate planning and probate issues. These organizations often have income eligibility requirements and other criteria for their services, so individuals are advised to review eligibility criteria beforehand . Additionally, many law firms, including those that focus on estate and probate matters, offer free initial consultations where individuals can discuss their situation and explore possible options and next steps. Finally, the Colorado Bar Association and its local divisions may have referral services that match individuals with appropriate legal representation. Finding the right resource is key to navigating next of kin laws smoothly and effectively.