What Exactly Is a Contract Note?

Contract note refers to a written record of a transaction done by a client with his/her stock broker. It is a complete record of every trade and related fees and charges of a specific day/week/month entered into by a client with his broker. A contract note must be duly signed by the broker and sent to the client. It is an important record used by the client to check the details of his trades and the commissions, levies , fees and other charges paid by him.

Securities Transaction Tax will be payable as per the relevant law for the underlying trades. The consideration paid/received by the client could be in cash or by way of a book entry, if the client has a credit balance in his broking account. The contract note will have a unique Contract Number that will help the client to reconcile the contract note with the order placed by him. Therefore, the signature of the broker will help the client to validate the correctness of the contract note.

Components of a Contract Note

Contract notes are generally issued little time after the transaction is completed, although certain exchanges only permit electronic delivery. Contract notes generated on behalf of the seller evidencing the sale of securities usually go to the buyer now. One of its many purposes is to act as the key evidence in calculating any profits or losses for the purposes of tax returns.

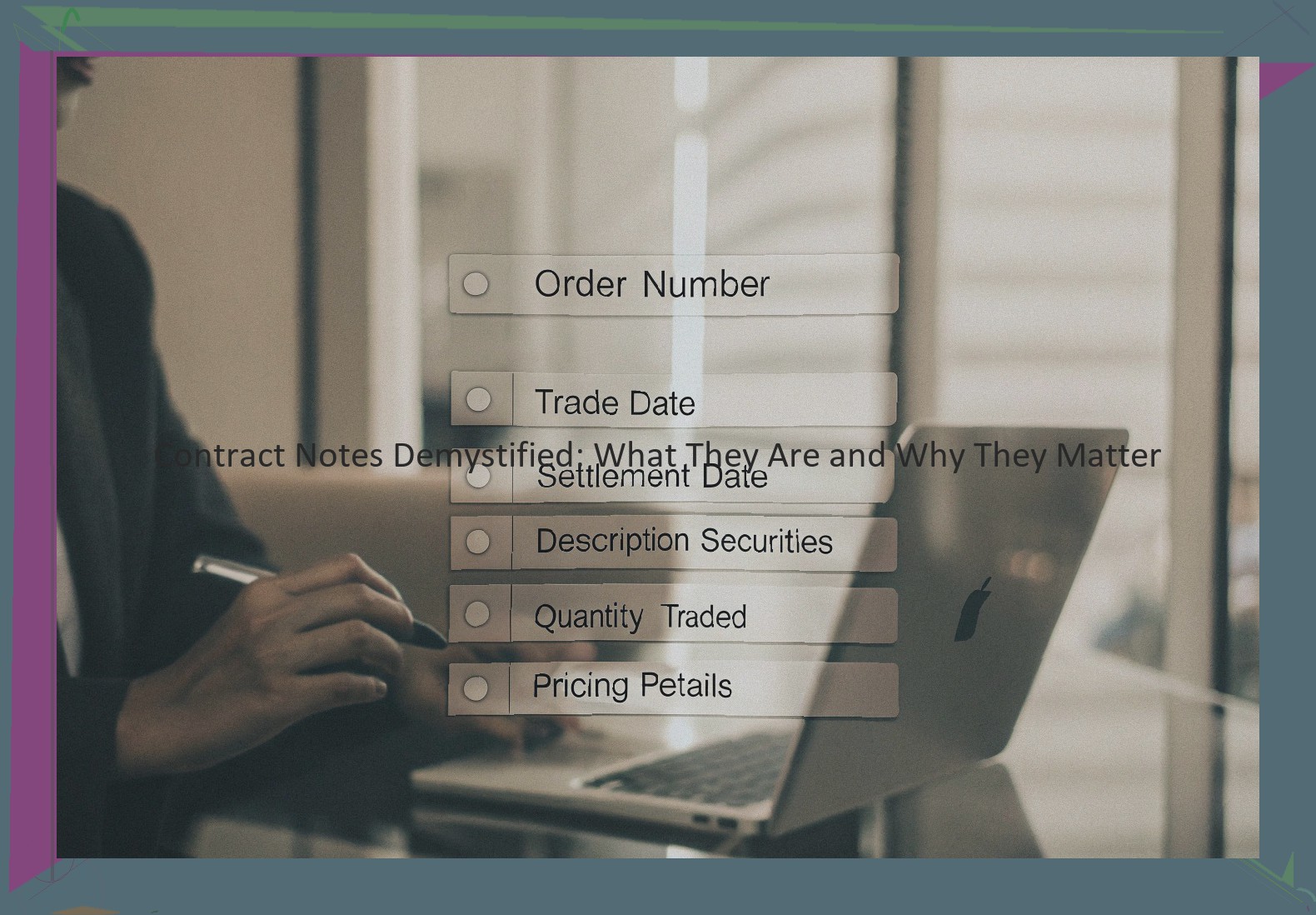

The contract note must contain:

Order Number

Trade date

Settlement date

Description of securities and particulars of the issuer

Quantity traded

Pricing details

The contract notes must also state whether the buyer is a market maker. A market maker contract note issued to a market maker should contain the following:

Statement of the market maker

Statement of date of last quotation

Statement of date before which the trade should be settled with the company as well as the details of the seller.

Contract Note Regulations

Certain legal and regulatory requirements govern the content of contract notes for transactions in financial securities. The relevant rules are primarily set out by the Financial Conduct Authority (the FCA), the London Stock Exchange (the Exchange) and the International Capital Market Association (ICMA).

The FCA’s client assets regime (CASS) contains rules that require the person executing a transaction to send a contract note to clients. A contract note should be provided as soon as reasonably practicable after the transaction is carried out. However, there is no requirement for the contract note to be sent immediately. When money received or paid out by a client is not equal to the value of securities purchased or sold, for example, the difference between the value of the transaction and the consideration paid by or to the client is often paid in the form of a commission. In these cases, the contract note need not be sent until the end of the day on which the transaction is carried out. Bear in mind that the requirement to send a contract note may also include transactions carried out by a firm’s agents or associates.

Contract notes issued by members of the Exchange must contain certain information. For example, transaction details, such as the size, price and price basis must be given. As mentioned above, any commission paid or payable should also be included. ICMA rules are similar. Rule 4, Part B of its Rules of Good Practice provides that members must promptly issue accurate contract notes to clients.

Significance of Contract Notes for Investors

The foremost importance of contract notes is that they give proof of transactions. When you get into any legal transaction then it is usually expected that you will receive proof of the financial transaction. Since share trading is a legal transaction, you have all rights to receive proof of the transaction, which in this case is a contract note. For starters, when you have a physical contract note then it is not possible for either party to change or alter the details of the transaction. Moreover, both the parties have signed the contract. So, no matter what the transaction is , proof is important and what is better proof than the contract note? Next, contract notes are important so that you can track your investments and investment performance. If you want to check the commissions rate and other charges levied by your stockbroker then you can view the contract notes over time and come to a logical conclusion of which broker offers you the best services. Lastly, as an investor, you would need to file your tax returns. For that, you will also have to check the transaction history, which is also available on the contract notes.

Contract Note Mistakes and Remedies

While brokerages have complete access to all trades buyers and sellers have executed, there can be a discrepancy between the information the brokerage is working with versus you as an investor. Sometimes contract notes can include incorrect trade details such as number of shares, pricing, buy/sell rates, etc. While brokerages have complete access to all involved parties’ trade details, there is a possibility of errors occurring during the contract notes generation process.

Common Errors: The most common errors that occur are incorrect trade details such as:

How to Address the Issue: The best way to address the issue of an incorrect contract note or error in contract note is to cross-reference data from different sources such as your brokerage’s back office and with your broker. If you do not receive satisfactory answers from these independent sources or if they suggest that the information listed on your contract note is incorrect, contact your brokerage to explain the situation. It helps to have printed proof of the true values to show to your brokerage as evidence for why the contract note should be revised.

Electronic Contract Notes: The Future of Trade Documentation

The world of trade documentation and record keeping underwent a significant evolution after the conduct of the first electronic trade. There exist now no more than a few physical payment exemptions which include cash, stamp duty, and credit notes attached to invoices. The sales and purchase of goods, even on credit , are done electronically immediately after the transaction is completed by issuance of contract notes.

The benefits of electronic contract notes are numerous. They are not only easy to access but are also easier to keep track of as they are all stored in one location and can be easily located by typing the name of the other party to the transaction. They benefit the environment by saving paper that would have gone into maintenance of the archives or registers previously maintained for paper records. They save cost and improve efficiency as storage archives and registers are no longer required. The cost involved in maintaining electronic records is also lower than previous storage methods of paper printouts. Communication is easier in the sense that the records can be easily emailed to the counterparties in the case of loss or burning, etc. They have also improved the security of records, including safeguarding against frauds, and misappropriations of documents, especially when invoices are raised and dispatched electronically.